The introduction of the new Aged Care Act on 1 July 2025 means changes to the regulatory activities the Commission undertakes, requiring new charging arrangements. This Cost Recovery Consultation Paper provides information on we propose to implement cost recovery charging for provider registration, renewal of registration and provider-initiated variations to registration.

The introduction of the new Aged Care Act on 1 July 2025 means changes to the regulatory activities the Commission undertakes, requiring new charging arrangements.

This guide answers frequently asked questions relating to our Cost Recovery Consultation Paper. It should be read alongside the full Consultation Paper.

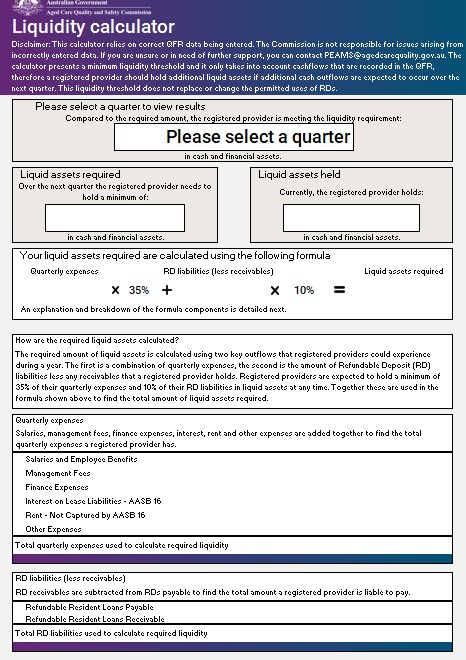

This calculator informs registered providers of the minimum level of liquid assets they are required to hold calculated based on Quarterly Financial Report (QFR) financial statements.

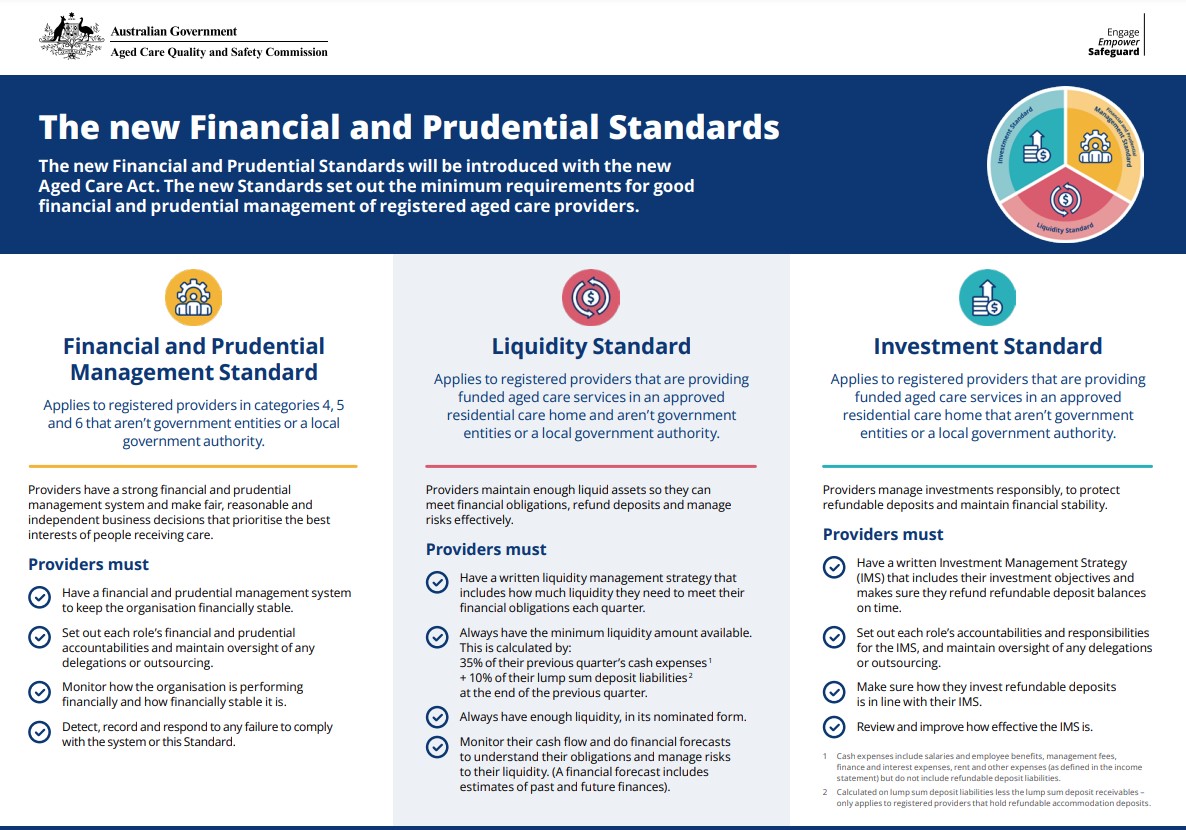

The new Financial and Prudential Standards will be introduced with the commencement of the new Aged Care Act. The new Standards set out the minimum requirements for good financial and prudential management of registered aged care providers. Registered providers must comply with the Financial and Prudential Standards that apply to them as a condition of their registration.

The new Financial and Prudential Standards will be introduced with the new Aged Care Act. The new Standards set out the minimum requirements for good financial and prudential management of registered aged care providers.

Financial and Prudential Standards – consultation draft – this is the latest version of the draft legislation which outlines the proposed requirements for providers

Outbreak management planning is a key part of infection prevention and control. This document supports both the development of a new outbreak management plan (OMP) and the quality assurance of existing plans. It details common OMP sections to get you started as you tailor your OMP to your service.

This resource may refer to information that will be updated from 1 July 2025 to align with the new Aged Care Act and Quality Standards.

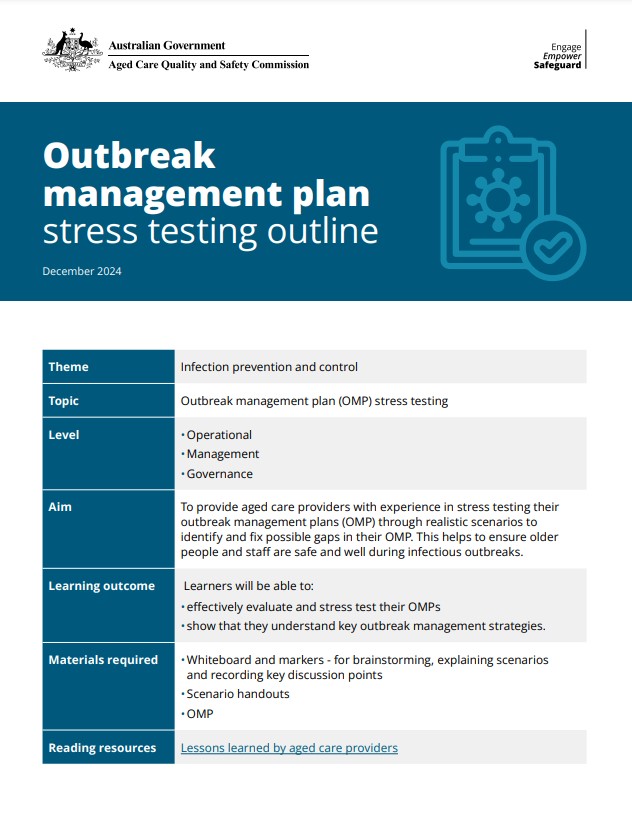

Having a comprehensive and organisation-specific outbreak management plan (OMP) helps your organisation to be prepared for the management of infections and outbreaks within your service. A key part of this readiness is ensuring that your OMP is fit-for-purpose and that everyone across the organisation can implement it if required. One way to maintain readiness and support continuous improvement of your OMP is to run regular drills, or stress tests, of your plan.

This Regulatory Bulletin explains approved providers’ responsibilities relating to COVID-19 vaccinations and infection prevention and control. It details how the Aged Care Quality and Safety Commission (Commission) is regulating these responsibilities and responding to providers found to be non-compliant.

This aged care financial reports calendar details due dates and auditing requirements for 2025 reports.

Joint letter on Winter outbreaks to Board Chairs, Residential Aged Care Providers from the Chief Medical Officer, Professor Paul Kelly and Commissioner Janet Anderson PSM.

Letter from Commissioner Janet Anderson PSM and Chief Clinical Advisory Dr Melanie Wroth to residential aged care providers and people living in residential aged care homes on the importance of being up to date with COVID-19 vaccine boosters.

People who enter residential care can pay for their accommodation costs with:

- a refundable deposit

- a daily payment

- a combination of a refundable deposit and a daily payment.

When a person transfers to another service, permanently leaves care or passes away, you need to refund their refundable deposit.

You can use refundable deposits to generate income and to fund investments and permitted expenses. The primary purpose of using refundable deposits must be to provide residential and flexible aged care.

This fact sheet explains what you can do if you have been overcharged a refundable accommodation deposit (RAD) or daily accommodation payment (DAP) by your provider.

The Prudential Standards contained in the Aged Care Act 1997 (Act) and the Fees and Payments Principles 2014 (No. 2) detail your responsibilities for the use and management of your residents' refundable accommodation deposits (RADs).

Section 52G-3 of the Act states that the Minister for Aged Care may set a maximum amount of accommodation deposit. Currently, this maximum amount is $550,000 as a RAD (or the equivalent Daily Accommodation Payment (DAP)).

This fact sheet includes suggested questions you can ask your provider about how prepared they are for an infectious disease outbreak (including COVID-19). It also includes links to a range of resources to help you feel safe, informed and connected.

A fact sheet that informs providers of their governing body membership requirements.

A factsheet introducing providers to prudential audits; a mandatory activity the Commission undertakes with providers to measure and support their performance against the Prudential Standards.

This aged care financial reports calendar details due dates and auditing requirements for 2024 reports.